In most cases, you will need life insurance to ensure the care of dependents. Occasionally, you will not, but you should know for sure, so speak to an advisor before you decide. And there is no short answer to the question “how much life insurance do I need?” That’s why getting advice from a qualified advisor is so important. Together, your advisor will help you to determine what your needs are and work within your budget to tailor a plan that works specifically for you. Read on below to learn more.

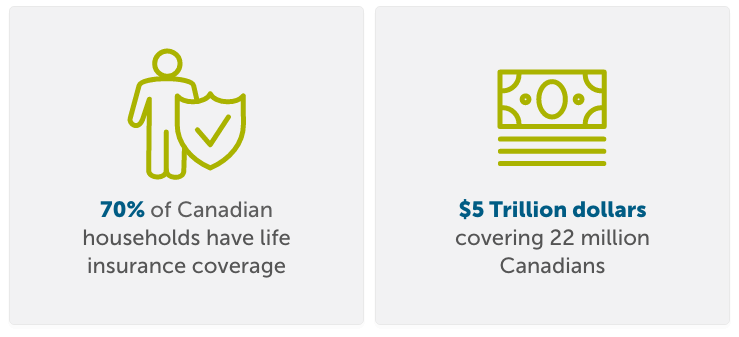

The Life Insurance Marketing Research Association (LIMRA) extrapolated some figures from a 2019 survey of Canadian Households. Here’s what they found. Approximately 10.7 million Canadian households have life insurance coverage. That’s almost 70%. How much do they own? The overall total of life insurance coverage comes to $5 Trillion dollars, covering 22 million Canadians according to Canadian Life & Health Insurance Facts, 2020 Edition. That sounds like a lot of coverage.

Broken down by household however, it works out to an average of $432,000. That may not even cover the mortgage. A number of Canadians have life insurance through work. It amounts to about 37% of the total coverage on average. If you were to lose your job, your employer life insurance coverage would disappear. If you or your family has to live on what’s left after paying for last expenses and some debts, the balance may not go very far or last very long.

30% of Canadian households believe they need more coverage or about 2.4 million households. LIMRA estimated that the average under insured household needs an extra $150,000 of coverage on average. Average needs vary across the country depending on cost of living, whether you own a home, have children or other dependents and your stage of life, just to name a few considerations. The pandemic along with other economic pressures have resulted in fewer and fewer employers providing company benefits like life insurance. People have been laid off and lost their jobs. That means the ballooning figures of how much life insurance people have and how many are covered is bursting. Just like other needs in life, like saving for retirement, Canadians need to be self-sufficient and rely on themselves to create and build the dollars needed to address their various life events and stages of life.

Think about that mortgage you may have. The cost of a home varies widely across the country. Demand is different for different kinds of homes in different areas. Your earnings in Toronto may not be comparable to the earnings of someone in Moncton. Housing prices and the mortgages home buyers take on are vastly different.

Some questions to consider:

- If you bought a home as a couple, how will the survivor handle the payments when one of you isn’t around to contribute? The location may be important to both of you for any number of reasons. Moving may not be easy. Finding another home may be daunting and frustrating.

- Will your partner be faced with a longer commute or a more expensive one?

- Will the kids have to switch schools or rely on busing to get there?

- What about the convenience of shopping, health care services and church?

- A lot of thought and consideration went into the home you own. How much do you want to protect all that? Are you thinking about life events and their accompanying responsibilities, like marriage, having a child, buying a home, building a business, obligations you may have or dreams you want to protect?

- What about your unpaid caregiving of aging parents and loved ones? And the time off work or out of pocket expenses that go along with that?

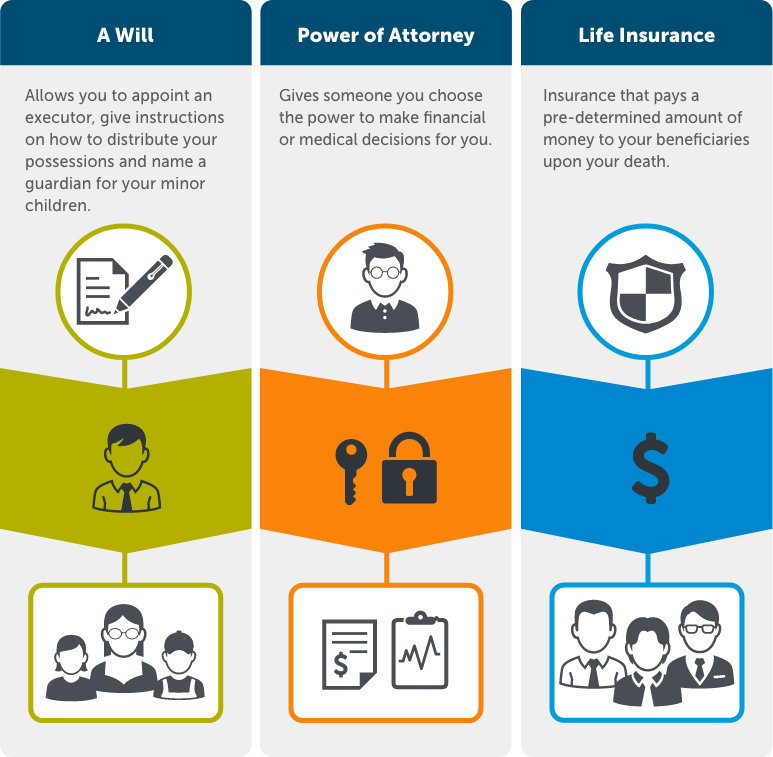

This isn’t so much related to your age as it is to your stage of life. More Canadians are thinking about buying coverage to make sure there is money available to pay off debts, provide income to families and protect those dreams and aspirations built together. A lot of them have been putting off discussions let alone decisions about buying life insurance. Going back to those LIMRA studies, 43% of households said they were more inclined to buy life insurance in the next year. And that was before the pandemic hit! Life insurance plays an important role in estate planning. Estate planning, or better put, legacy planning, is documenting what you want to happen with the things you have, the people you care about and the favourite causes you support. While you may think that all of this is only for the wealthy, it can mean the most for families with modest means since they can afford to lose the least.

Life insurance is still the most cost effective and tax efficient way to create, build, preserve and transfer wealth to heirs and favourite causes. And wealth is relative. It doesn’t mean the same thing to different people. You need to figure out what it means to you or what you want it to mean to you, your family and the things and issues you care about.

To answer the question “How much life insurance do I need?” think about this: What do you care about? You see, life insurance is for people who care. Make a list of the things you care about, the debts you’ve taken on, the debts that will be created when you pass away, suddenly or after amassing a lot of expenses due to a lingering illness or disability. Those expenses may be yours. They may be the ones your caregivers, usually family, have built up. There may be things they lost because of time taken away from work, job opportunities they passed up and savings they had to forego.

Life insurance can provide, protect and preserve the standard of life you dreamed about with your spouse/ partner and for your children. It can do the same for the business you own. Life insurance provides financial security and peace of mind.

Here is a scenario I often present to people, whether they are looking at individual needs or business needs for cash, particularly when death strikes.

There are 4 ways of paying for a debt or providing cash needed when you pass away.

-

You can use cash.

Pay for everything dollar for dollar. The people who have to come up with the money (e.g. to pay a debt) need access to ready cash, as much as is needed on a moment’s notice. You see, you don’t know when that will happen. You may need a lot of cash. That means you can’t be investing it in the market where there is risk involved and values can go up and down. This has to be a sure thing. It needs to be liquid. There's a cost to you in terms of giving up a better return on your money and opportunities lost.

-

You can liquidate assets.

Someone has to sell one or more of your assets and relatively fast. Which assets do they sell? They should choose the assets that are easiest to sell, regardless of how precious they may be or for whom they were intended. I’m pretty sure you didn’t grow an asset, just to have it sold at liquidation prices. The cost here is the original price plus the amount lost to discounts at an auction. Check out this table on sample Business Asset Liquidation Values. It may cost your estate two dollars or more for each dollar needed.

-

You (or your family) can borrow the money.

Can they get credit and at reasonable rates, under reasonable repayment terms? Even if they can, is that preferred over other needs they may have for borrowing money? The cost is the original amount of money needed plus interest. That interest is not tax deductible.

-

Use life insurance.

This option costs pennies for each dollar needed. It arrives exactly when needed for the amount covered. The cost is generally less than the interest charged under option 3. You need to pay the equivalent of that interest cost while you are alive and for perhaps a guaranteed limited payment period. Your family gets the amount needed tax free on your passing. The balance of the monies it will cost under options 1 to 3 can be invested, preserved or otherwise spent.

Which option is the most cost effective? Which one can be guaranteed to do the job? Which option would you and your family prefer?

I suppose there is a fifth option. Give up on those dreams, obligations and lifestyles you and your family care about when you pass away. Is that the legacy you want to leave behind?

If you’re confused or overwhelmed by all of the names, choices, bells and whistles associated with life insurance, you’re not alone. And part of that is not your fault. You do owe it to yourself and the people and issues you care about to educate yourself on the basics. Then seek out a licensed and preferably accredited financial advisor to help you out with some of the details, where to buy it and what kind to buy. There are some basics that are pretty easy to understand.

There are two kinds of life insurance, term and permanent. Over time, these two kinds of life insurance are designed to cover off two kinds of needs and wants, temporary and permanent.

What is Term Insurance?

Term insurance covers you for a period of time. You rent it. You may be able to renew it, at higher and higher rates. Eventually the coverage ends and for most people it ends before you do, typically around age 75. Average life expectancy is now in the 80s.

For more on term insurance click here

What is Permanent or Whole Life Insurance?

Permanent insurance covers you for as long as you live. That’s why you hear and read the name, whole life. You may also have heard the name Term 100. As you may easily figure out that describes a policy that provides coverage until age 100. At that age it generally becomes paid up. The insurance company then pays out the death benefit or sum insured when you pass away.

For more on permanent insurance click here

Does Life Insurance just Provide Death Benefits?

The recently published Canadian Life & Health Insurance Facts, 2020 Edition, shared that the industry paid out $12.1 Billion dollars in life insurance benefits last year. Of that total, $4.4 Billion was paid to living policyholders as disability benefits, cash surrenders or dividends.

Cash Value Life Insurance

Let’s go back to permanent life insurance and those cash values or growing equity in those contracts. Remember, you are essentially renting term insurance, so like renting a home or apartment, you aren’t building any equity into it for yourself.

You can access the cash value in a permanent life insurance policy in various ways. You can borrow directly from the insurer or withdraw cash; no questions asked and with no contractual condition to pay it back. Either option will reduce the amount of coverage paid when you pass away. Alternatively, you can use the cash value of the policy, perhaps even the sum insured or death benefit, as collateral for a bank loan. Ask about any income tax implications of borrowing or withdrawing from the cash value of your policy.

Is life insurance an investment? It can be. Many individuals and business owners see it as an important asset class. It offers them the ability to deposit money and grow it on a tax-sheltered basis. That tax-sheltered growth may be passed on to spouses/partners or children intact and without triggering any income tax. It depends of course on how the policy is structured at the outset. The cash value is also paid out as part of the total sum insured or death benefit when the life insured passes away, all tax free.

You can downsize your permanent life insurance policy, perhaps to the point of having permanent coverage for a lower amount and no more payments. Think of it like owning a home with a mortgage and where you have built up some equity. You may decide far down the road to downsize your home and buy another one with the equity you built up. You move into your new home mortgage free.

You may do the same thing with permanent life insurance. The difference is that you don’t move policies. You keep the same one for a reduced amount of coverage and it’s completely paid for. That reduced amount of life insurance still has a cash value. That cash value will still grow, although more slowly than before and be paid out as part of the sum insured, tax free when you pass away.

Finally, if you don’t need the coverage anymore, you can cash it in and take the cash surrender value. There may be taxes to pay on that amount. More on that in another article on Life Insurance and Taxes.

What Can I Use the Cash Value for?

The cash values may be used for financial emergencies, a down payment on a home, a car or to help pay for education. They may be used to supplement retirement cash and income needs. They can form part of a tax sheltered legacy for children and grandchildren, particularly if the life insured is a child. What life event may create a need for easy to access cash, without a credit check or questions to answer?

So, What Kind of Life Insurance do I Need?

Temporary needs are best covered by term life insurance. Think about credit card debts, lines of credit, a mortgage, an income while children are at home or some business needs and obligations.

Permanent needs are best covered by permanent life insurance. Think about final expenses and covering capital gains taxes on death, especially if there is an intent to pass on certain assets to family like a cottage or business. Your surviving partner may need an ongoing income supplement. You may have a disabled or special needs child that requires lifetime care.

The Ideal Solution

The ideal solution needs to do two things. It needs to fit your need and it needs to fit your pocket book. It makes little sense to buy permanent or whole life insurance and not have enough left over to pay for other necessities in life. It makes no sense to buy permanent life insurance that only covers some of the need because you can’t afford to buy all of the permanent coverage you need. It may also not make sense to buy permanent coverage for a temporary need.

On the other hand, why buy term life insurance to cover a permanent need? Eventually the coverage ends and the need is still there. Meanwhile, the cost of that coverage keeps going up the older you get. You may be able to convert your term insurance to permanent insurance without providing evidence of insurability. In other words, look for a term insurance policy where you may be able to convert to permanent life insurance regardless of your health or the risks you take in life. Buying permanent life insurance late in life may really stress your budget because all life insurance is based in part on how old you are when you buy it.

Some needs will go away. Some needs will change. For most people, the ideal solution is probably a mix of term insurance and permanent life insurance coverage.You may have a permanent need that you presently can’t afford to cover with permanent insurance. Bottom line, buy whatever coverage will fully meet your needs today if you cannot afford to buy the right kind of insurance for any particular need. Just make sure the policy you buy is guaranteed to be both renewable and convertible. Plan on converting that term insurance to permanent coverage as your financial situation improves. Be careful about cancelling a life insurance policy because the original need went away. Other needs may have arisen and the needs that are still there may now need more money. Your health or habits may have changed too, and not for the better. That may make it harder to get life insurance at reasonable rates.

As you can probably figure out, most people would benefit from a combination of term insurance and permanent life insurance.

The quick answer: it depends.

There are as many rules of thumb as you have fingers and toes. The amount of life insurance you need is really an individual or family issue. Again, it depends on what you all care about protecting, providing or leaving as a legacy.

You will learn about a ballpark figure that uses between five and 10 times income. A better approach is to make a list of your needs and what it would cost to provide the necessary cash or income for each one. The best approach is to go through a financial needs analysis. This is a systematic way that you can use to document your various needs by category:

Life Insurance for Immediate Needs

Consider and add up immediate needs like funeral, final expenses, probate and estate settlement fees, legal fees, credit card bills and replenishing that emergency account which may have been spent. There may be capital gains taxes on appreciated assets and investments, including a vacation property and/or a business. You may have an agreement to buy out a business partner or have them buy you out, including when one of you dies. The business will struggle with only one of you left. Should both families struggle too?

Your passing may involve a move by your surviving family, which may cost quite a bit, depending on where they decide to go and why.

Life Insurance for Intermediate Needs

Then consider intermediate needs like providing an income stream for your partner for a period of time and of course your children while they are still at home or going to college or university. How many years of income might they need? Multiply your net income now by the number of years needed.

This category may include mortgage payments or paying off the mortgage, funding education costs for your children or spouse/partner, dealing with lines of credit or buying out a deceased business partner’s shares in a business. You may be concerned about a negative impact on your business if a key person passes away and consider Key Person Protection.

You may have been providing care for a parent or sibling. Where will the money come from to pay for what you provided in terms of cash and time? How much will it cost to replace you?

Life Insurance for Permanent Needs

Then there are longer term costs like ongoing income to supplement your surviving partner’s income, providing for a disabled or special needs child or other relative and supplementing retirement income. Your family may need to replace their cash and income spent on taking care of you. They may not have the time and resources to do this on their own.

Check out our online life insurance needs tool here or take a look at the following questions for individuals.

Some Other Questions to Consider:

- If you are married or living common law, how much do you contribute financially to the budget and your lifestyle?

- What would happen if you were to suddenly pass away? How would your spouse/partner handle the budget and be able to maintain the lifestyle that you built together

- What if there were dependent children as well?

- What if you are a single parent?

- Are you counting on support from the other parent?

- What happens when the other parent is not here anymore?

- What would happen to your children’s dreams and your dreams for them? How much do you care about that

- Are you putting money aside for your children’s education? Is it enough right now? What importance do you place on helping out with the funding of their education and the opportunities that will provide?

- A significant percentage of people have cared for, are caring for or expect to be providing care for a parent. You may be providing time and money. Who would replace you and what would that cost?

- If you have a mortgage on your home, do you want it paid off or at least significantly reduced if you passed away? What would it cost to protect and preserve your home? Check out these additional resources:

- Mortgage - There’s No Place Like Home (Rider)

- Mortgage - There’s No Place Like Home (Stand Alone)

- Do you have a favourite cause or charity you have been supporting? What role does philanthropy play in your life? What values do you want to express through your giving? What do you want to be remembered for? You can leave a lasting memory for pennies on the dollar by using some of these Charitable Estate Multiplier Strategies.

- Are you a business owner? Check out these simple questionnaires. Do you need a buy sell agreement? And should your buy sell agreement be funded by life insurance?

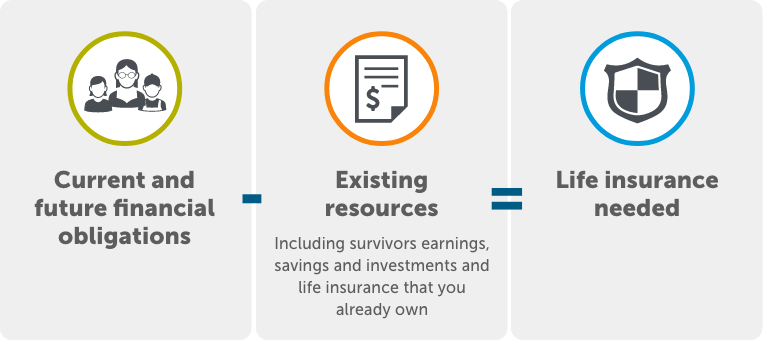

The amount of life insurance coverage you need is based on what life events you are going through and what stage of life you are in. It also depends on any sources of cash and income you may already have. Once you complete your list of immediate, intermediate and long term needs, figure out what sources of cash and income will be available to pay for all of this. Include life insurance you already own. Subtract that from the total needs to arrive at a net amount. The gaps can be filled with life insurance. And in many cases, especially for younger people, it will be a combination of term and permanent coverage. Current and future financial obligations - Existing sources of income = Life insurance needed Including survivors earnings, savings and investments and life insurance that you already own

Yes, if you want advice and all of your questions answered.

Do it for yourself, not by yourself.

Work with a licensed financial advisor, one who is subject to rules of professional conduct and a code of ethics. Peace of mind comes with the right advisor! Let us introduce you today. Find an advisor near me

Remember to ask yourself these three questions:

- What do you care about?

- What do you want to be remembered for?

- Why life insurance?

Why the Author Owns Life Insurance

I remember that it started with an innocent ice skating date. It was cold. We held hands and had hot chocolate. Lorna and I started going out, we talked a lot, found out we shared a lot of dreams and eventually decided to make them happen together. We’ve been building memories, sharing dreams and responsibilities for a lifetime.

Watching Sarah’s birth was like magic. When she held my finger in her tiny hand, I knew she was counting on me to keep her safe and free of worry.

When Matthew had nightmares, I’d rock him to sleep and sing some songs. He depended on us for comfortable nights in a cozy bed, away from the problems grown-ups had. Like all children, Sarah and Matthew wanted to have time to be kids, to be like their friends, to do stuff. We wanted them to grow up like that too.

I remember that the kids would come home everyday from school, often with friends in tow. They’d yell, “Hi Mom, I’m home,” and Lorna would be there with snacks and fresh baked goodies. They’d curl up on the couch and share their joys and pains. It was important for all of us.

I, on the other hand, travelled a lot; I still do. I'd talk to the kids about school, friend problems; help them with their homework, their essays and projects, even though I could be 1000s of miles away. It was good, just not the same as being home as regularly, like we planned Lorna to be. Lorna has loved her career. She could at least choose to work and balance her busy personal life and time with our kids with her vocation as a nurse. She was not forced to work long hours while trying to raise a family.

We lived close to schools, parks, the church and friends. We had a great location to raise our children. Sarah graduated from University and Law School, a regular Dean's Honour list student. She could afford to focus on her studies to make that dream come true. Matthew pursued his dream of a career in nursing, focusing on the stresses of school and yeah, girls, not whether he could afford to earn his degrees.

We've had mortgages and car payments, accidents and vacations. There were piano lessons, dance lessons and recitals. The money was sometimes tight, but it was always there. There were the sports activities, coaching, the parties, the dances and the family outings, things that kids and every family like to do and want to do. We dreamed of going on some wonderful vacations too, traveling to far away places. We've been able to do all that and more.

For this and a host of other memories, I own life insurance, so that dreams would come true, no matter what happened to me. But if you asked me what I pay for it, well, I don't remember because that is less important to me.

Peter A. Wouters

Director, Tax Retirement & Estate Planning Services, Empire Life

15 minute read