Protect your home with life insurance

Buying a home can be the single biggest purchase an individual will ever make.

According to statistics released this year by The Canadian Real Estate Association (CREA), national home sales declined for the third consecutive month in December 2013. However, the CREA indicates that 475,000 homes were sold nationally, a 4% increase from 2012.

For most buyers, that purchase involves a substantial mortgage and years of debt.

It is important for homeowners to know that there are options when it comes to protecting their mortgage and their family's finances from the unexpected.

Homeowners have the option of purchasing mortgage insurance from mortgage lenders or through an individual insurance policy offered by an insurance company.

When comparing various features, homeowners can benefit from purchasing a life insurance policy instead of mortgage insurance from a mortgage lender.

Here are some of the primary advantages of Empire Life term insurance:

-

No need to re-apply for coverage if you move or need to re-finance

With lender mortgage insurance, if the homeowner switches banks, moves, or sells their home, they will have to take out another policy. This could be a challenge if there have been any health changes.

-

You choose your beneficiaries and they decide how the money is used

With lender mortgage insurance, if the homeowner passes away, the lender will simply pay off the mortgage balance. In contrast, under an individual life insurance policy, the homeowner can choose one or multiple beneficiaries and they can use the money for other debts and living expenses as well.

-

With term life insurance your coverage remains the same, even as your mortgage decreases

With lender mortgage insurance, the coverage declines as the insured's mortgage declines. This means the insured gets less and less for the premiums that they are paying. For example, if a $250,000 mortgage insurance policy starts at $34 a month, it may seem like a good deal. But as the mortgage reduces to $150,000 and the premiums remain at $34 a month, the policy’s less value.

-

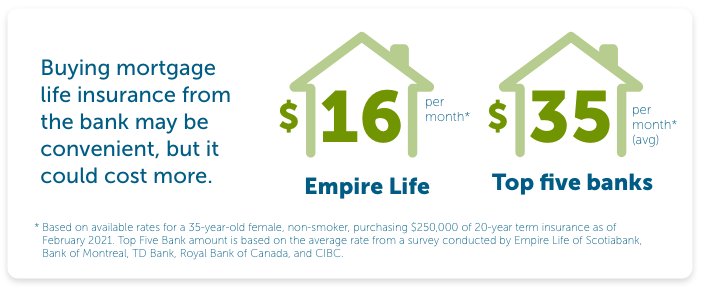

Buying mortgage insurance from the bank may be convenient, but it could cost more

In general, the rates for lender mortgage insurance are typically higher than those policies sold by insurance companies for term insurance. For example, a 35 year old female non-smoker purchasing $250,000 of 20-year term insurance would save around 54% with Empire Life Solution 20 versus the average of the Big Five banks’ mortgage insurance products*.

* Based on available rates for a 35-year-old female, non-smoker, purchasing $250,000 of 20-year term insurance as of February 2021. Top Five Bank amount is based on the average rate from a survey conducted by Empire Life of Scotiabank, Bank of Montreal, TD Bank, Royal Bank of Canada, and CIBC.

Empire Life’s Solution 20 is a great product that offers simplicity, more benefits and greater flexibility over mortgage insurance offered by mortgage lenders. Check out this great term insurance product!

Empire Life’s Solution 20 is a great product that offers simplicity, more benefits and greater flexibility over mortgage insurance offered by mortgage lenders. Check out this great term insurance product!

Did You Know?

On a monthly basis, life insurance can cost less than a cup of coffee?

Consider this

$84/month for coffee1 vs. $11.70/month for life insurance2

Buy NowWatch a Video

1

Based on a cup of coffee at $2.45, purchased 31 days per month.

2

Initial monthly cost for a healthy, 30 year old female, non-smoker purchasing $250,000 of Empire Life Simplified 10 term life insurance as of January 31, 2023. Premiums increase every 10 years.